The upcoming offshore wind lease auction on August 29th will initiate an important and long-awaited expansion of offshore wind development into the nation’s hotspot of marine infrastructure and energy. The three lease areas’ collective 3.65 gigawatts could feasibly be divided between Texas and Louisiana. Adding offshore wind power would diversify and thus strengthen these states’ energy portfolios. Several counteracting factors at play in Louisiana and Texas, including differing state policy signals, market access, and regulatory environments, will impact the feasibility and development process for new projects, which will ultimately impact bidders’ valuations of these lease areas.

Xodus Group and Daymark Energy Advisors are collaborating on advancing the development and deployment of offshore wind projects across North America. We explore the factors influencing developers’ bids in the Gulf of Mexico auction below.

State policy environment

Offshore wind development in the US has been driven primarily by state supported offshore wind procurements held to meet clean energy policy objectives. In 2022, Louisiana set an offshore wind procurement goal of 5 gigawatts by 2035 and has begun pursuing near-shore wind development in state waters, with multiple proposals already under consideration. However, efforts supporting Gulf of Mexico have not proceeded at pace. Despite the governor’s years-long advocacy, Louisiana has not established a regulatory framework or other support schemes for offshore wind development, leaving a variety of risks for developers related to offtake opportunities, project timelines, and regulatory processes.

Unlike Louisiana, Texas policymakers have not signaled support for offshore wind development. Texas does not have state legislative or executive initiatives promoting development in the Gulf of Mexico, even with the upcoming offshore wind lease auction. In 2005, the state set the goal of installing 10 gigawatts of renewable capacity by 2025 in their legally binding RPS. The state surpassed this goal in 2009 and has since lapped it five times over, thanks to its strong onshore wind and solar resources, supportive transmission development policies, and investment environment. The state has not increased its RPS requirements or implemented any new policies that would drive demand for offshore wind. Due to these factors, winners of lease areas looking to sell into Texas may have to find creative solutions for power offtake, which may include selling power directly to corporate buyers or municipalities with clean energy commitments (including 24/7 renewable goals) or interconnecting to the Midcontinent Independent System Operator (MISO) grid in the eastern portion of Texas to access contract counterparties in that market. Unfamiliar or high-cost offtake creates risk for developers, which could impact bid prices on Texas lease areas.

Market size and access

Louisiana is part of the MISO system, one of the RTO markets in the Eastern Interconnection of the US. MISO is one of the largest systems in the US, with an expected peak load of approximately 130 gigawatts in 2023. Interconnecting an offshore wind project into this market provides access to buyers throughout the MISO market, including those in states with clean energy and decarbonization policies. Beyond Louisiana, the states with clean energy policies are located primarily in the north of MISO. There are transmission constraints that limit moving energy from southern to northern MISO. These constraints do not preclude selling to a northern off-taker, but there may be additional transmission costs or congestion risks associated with such arrangements.

Most of Texas is served by its own electrical grid, which has limited points of interconnection with the neighboring Eastern and Western Interconnections. The Electric Reliability Council of Texas (ERCOT) operates the Texas Interconnection. ERCOT has been under pressure to increase the reliability of the electrical grid since the 2021 Texas power crisis, in which an extreme winter storm led to failure of many energy generation facilities, inability to meet demand, and tragic loss of life. Concerns were heightened amid record high temperatures this summer when ERCOT set 10 new all-time peak power demand records, exceeding 85 gigawatts. Pablo Vegas, the CEO of ERCOT, has applauded Texas lawmakers’ efforts to incentivize natural gas power generation as a means of addressing the reliability problem. He has acknowledged the important role of renewables in the electrical grid, but has expressed uncertainty over their ability to meet rising demand reliably due to their intermittency. ERCOT has not studied options for offshore wind integration, creating uncertainty about the market size for offshore wind power in Texas.

Energy regulatory environment

Differences in the energy regulatory environments in Texas and Louisiana could impact the market’s assessment of the value of offshore wind lease areas and the prospects for long-term offshore wind development.

Louisiana is a traditionally regulated state with retail load served primarily by vertically integrated utilities. Utilities generally require the approval of the state regulatory commission to recover the cost of new power supply investments (including new capacity additions as well as PPAs) from customers. Cost recovery presents a hurdle for generation project approval, especially if a project’s costs are higher than those of non-renewable alternatives. Renewable policies or targets, such as Louisiana’s new 5-gigawatt offshore wind target, can provide a justification that helps with the approval process. This regulated structure is akin to the development path for Dominion Energy’s Coastal Virginia Offshore Wind Project.

Texas, on the other hand, is a so-called deregulated state, like most Northeast and Mid-Atlantic states, where generator companies compete to sell power into the market and customers purchase from competitive retail suppliers. ERCOT operates an energy-only market, under which it only pays generators for the power delivered to the grid on a day-to-day basis. This structure poses certain risks to merchant generators, and offshore wind developers will likely need long-term off-take contracts to enable project financing, similar to PPAs executed for offshore wind projects in New England and New York.

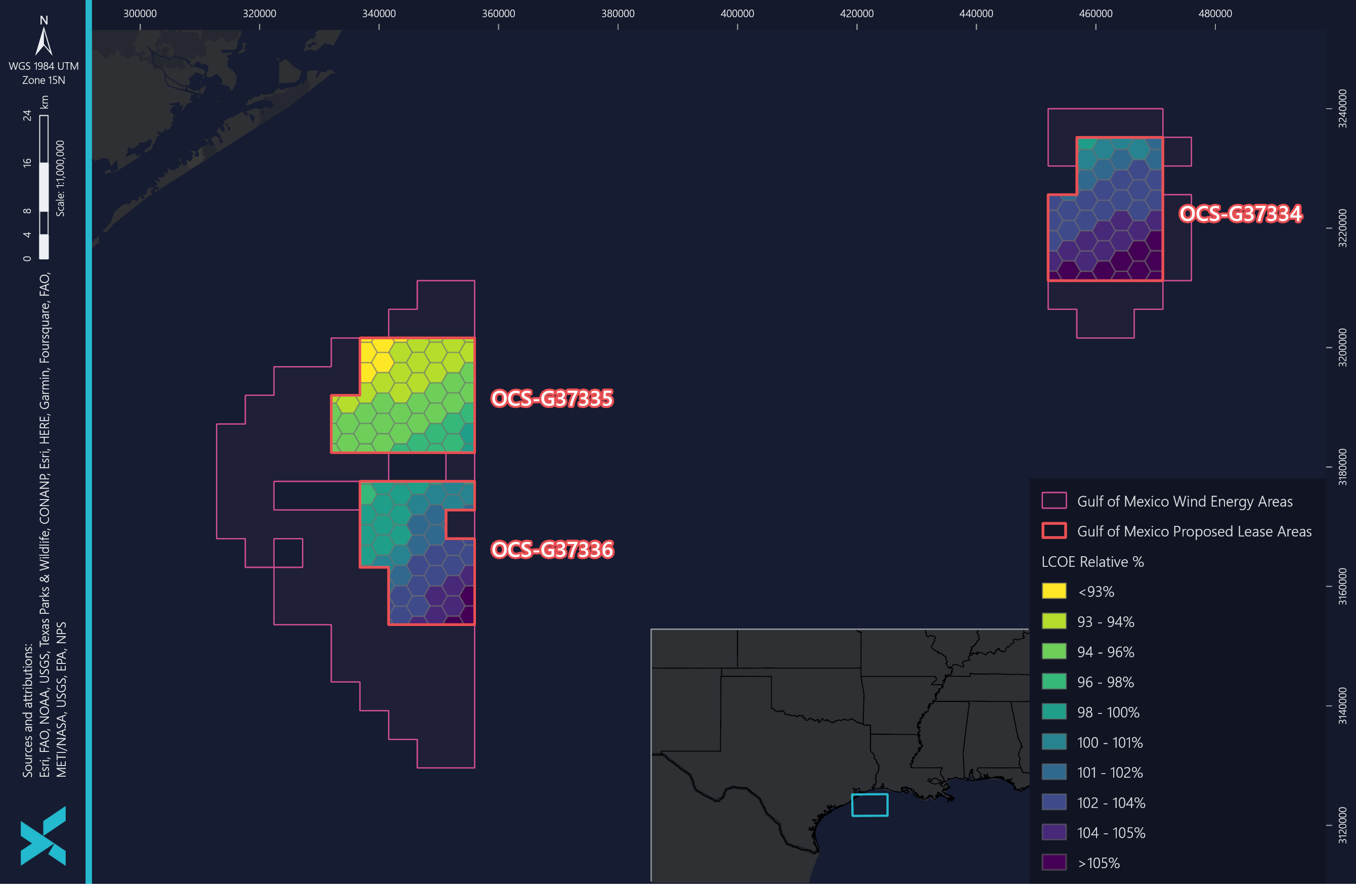

In addition to these three, a myriad of other factors may be considered by lease area bidders, such as the growing hydrogen market, offshore decarbonization efforts, or other novel route-to-market strategies. Daymark and Xodus are closely engaged with offshore wind development in the Gulf of Mexico and in markets across the country. If you’re looking for insight on route-to-market analysis, competitive procurement bid support, regulatory and market advisory services, optimal POI identification and interconnection analysis, LCOE modeling, or other related services, please reach out to Jeff Bower at jbower@daymarkea.com or Hillary Bright at hillary.bright@xodusgroup.com.